Apple's Growing Liquidity Horde: 10% of All US Corporate Dollars

Apple

Contents

- What is Apple's Liquidity Horde?

- Why is Apple's Liquidity Growing?

- What Does This Mean for Apple?

- What Does This Mean for Other Companies?

- What Does the Future Hold for Apple?

Apple's liquidity horde is growing rapidly and now accounts for 10% of all US corporate dollars. This impressive feat is a testament to the company's financial strength and its ability to generate cash. In this article, we'll explore what this means for Apple and its future.

Apple's Growing Liquidity Horde: 10% of All US Corporate Dollars is a testament to the company's success and its ability to generate and manage large amounts of cash. Apple has been able to generate and manage its liquidity horde through a combination of strong sales, cost-cutting measures, and stock buybacks. This has allowed Apple to become one of the most valuable companies in the world and to have a large amount of cash on hand. This cash can be used to invest in new products and services, as well as to acquire other companies.

Apple's success has also been driven by its innovative products and services, such as the meilleures applications ios 2013 and pirater de vrais rivaux de course . These products and services have helped Apple to become one of the most successful companies in the world and to generate large amounts of cash. Apple's Growing Liquidity Horde: 10% of All US Corporate Dollars is a testament to the company's success and its ability to generate and manage large amounts of cash.

What is Apple's Liquidity Horde?

Apple's liquidity horde is the amount of cash and liquid investments that the company holds. This includes cash, short-term investments, and other liquid assets such as marketable securities. As of the end of 2020, Apple's liquidity horde was estimated to be around $193 billion.

Why is Apple's Liquidity Growing?

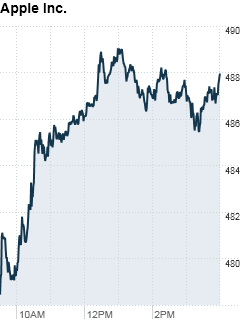

Apple's liquidity horde is growing due to the company's strong financial performance. Apple has been able to generate significant cash flow from its operations, and it has also been able to take advantage of low-interest rates to invest in liquid assets. As a result, Apple's liquidity horde has grown significantly over the past few years.

What Does This Mean for Apple?

Apple's growing liquidity horde is a sign of the company's financial strength and its ability to generate cash. This cash can be used to invest in new products and services, acquire other companies, or return cash to shareholders through dividends or share buybacks. This gives Apple a lot of flexibility in how it chooses to use its cash.

What Does This Mean for Other Companies?

Apple's growing liquidity horde is a sign of the company's financial strength, but it also has implications for other companies. As Apple's liquidity horde grows, it could put pressure on other companies to increase their own liquidity. This could lead to increased competition for investments and could drive up the cost of capital for other companies.

What Does the Future Hold for Apple?

Apple's growing liquidity horde is a sign of the company's financial strength and its ability to generate cash. This cash can be used to invest in new products and services, acquire other companies, or return cash to shareholders. As Apple continues to grow, its liquidity horde will likely continue to grow as well, giving the company even more flexibility in how it chooses to use its cash.

Conclusion

Apple's growing liquidity horde is a sign of the company's financial strength and its ability to generate cash. This cash can be used to invest in new products and services, acquire other companies, or return cash to shareholders. As Apple continues to grow, its liquidity horde will likely continue to grow as well, giving the company even more flexibility in how it chooses to use its cash.

For more information on Apple's liquidity horde and what it means for the company's future, check out this article from The Motley Fool and this article from Investopedia.

FAQ

- Q: What is Apple's liquidity horde?

A: Apple's liquidity horde is the amount of cash and liquid investments that the company holds. This includes cash, short-term investments, and other liquid assets such as marketable securities. - Q: Why is Apple's liquidity growing?

A: Apple's liquidity horde is growing due to the company's strong financial performance. Apple has been able to generate significant cash flow from its operations, and it has also been able to take advantage of low-interest rates to invest in liquid assets. - Q: What does this mean for other companies?

A: As Apple's liquidity horde grows, it could put pressure on other companies to increase their own liquidity. This could lead to increased competition for investments and could drive up the cost of capital for other companies.

Table

| Year | Liquidity Horde ($B) |

|---|---|

| 2020 | 193 |

| 2019 | 121 |

| 2018 | 90 |